Wine Country defies simple categorization. Napa versus Sonoma doesn't tell you much. Neither does price point, AVA, or even walkability versus acreage. The distinctions that actually determine whether you'll love where you land are more subtle—and more important.

On a map, Wine Country looks like a single destination. But in practice, a few miles in any direction can completely shift the energy of your weekend—moving you from the vibrant pulse of a town square to the profound silence of a hillside retreat.

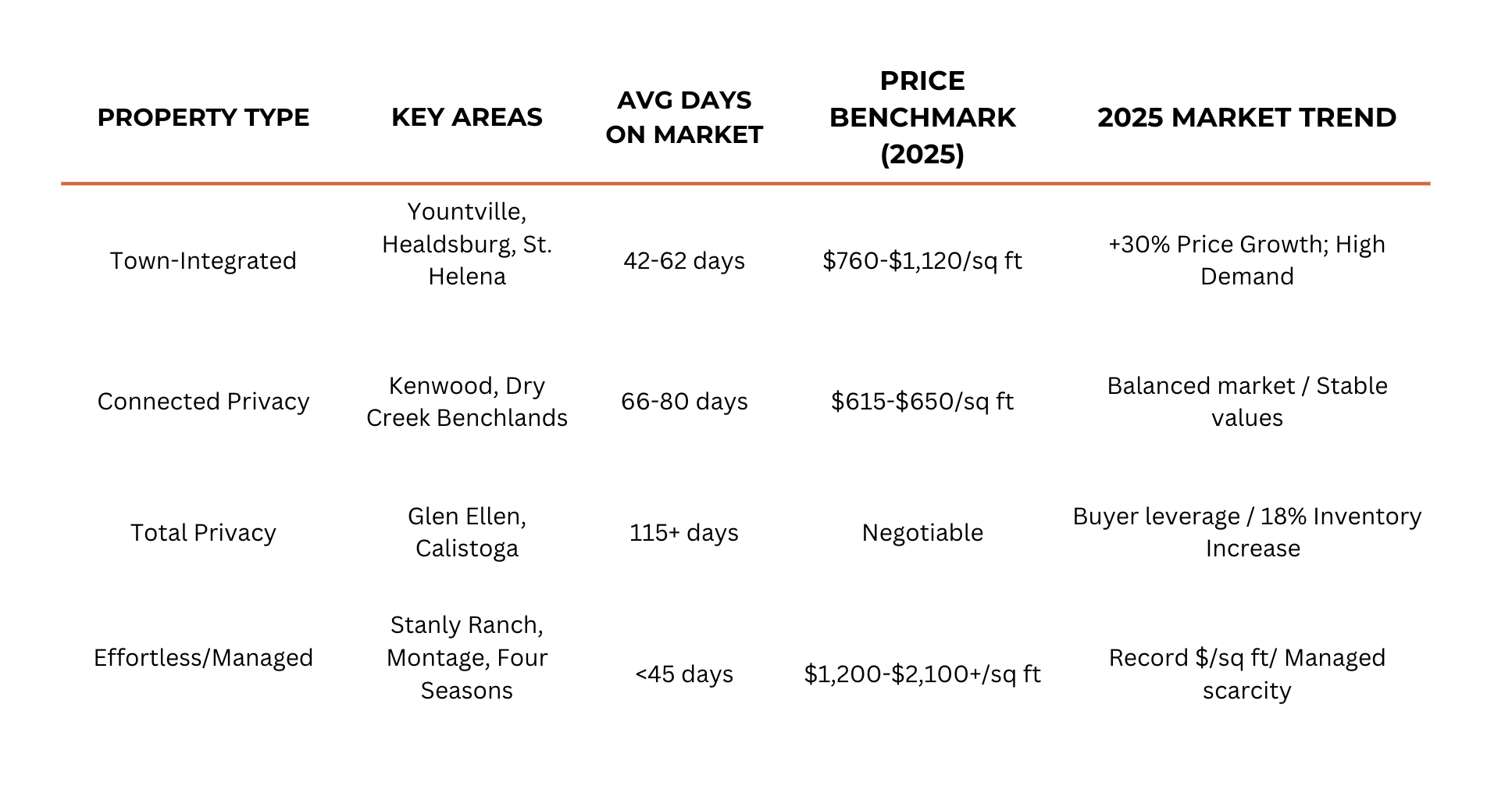

Long-term satisfaction comes down to understanding which lifestyle matches how you naturally want to spend unstructured time. And in 2025's more selective market, that matching process became more critical. The year-end data reveals distinct patterns across Wine Country's micro-markets—some moving with velocity, others offering negotiating leverage. For buyers, understanding these dynamics means knowing where competition is fierce and where opportunity exists. Here's how the different options break down across Wine Country, and what the 2025 year-end data reveals about each market and what it means for buyers in 2026.

1. Town-Integrated Living

Yountville, Healdsburg Plaza, St. Helena Main Street

You arrive Friday evening, park the car, and don't need your keys until Monday. Coffee is a three-minute walk. Dinner reservations happen spontaneously. Your guests entertain themselves because the town provides the infrastructure.

This is Wine Country for people who want proximity to create possibility—where walkability isn't just convenience, it's the entire social architecture of the weekend. You're in the center of things: farmers markets, gallery openings, wine bars, Michelin-starred restaurants, the energy of a true village lifestyle.

The trade-off: smaller lots (typically under an acre), less privacy, and premium pricing for that rare friction-free access. But for buyers who value the "park once" model—where the weekend unfolds on foot—that premium reflects genuine scarcity.

The Walkability Premium

Town-center properties continue to command strong demand even as the broader market cools. Across Yountville, Healdsburg, and St. Helena, the data tells a consistent story: limited inventory, faster absorption, and notable price momentum.

In-town properties are moving in 42-62 days on average—faster than other Wine Country segments. Median prices increased meaningfully in 2025, with some towns seeing growth of 30%+ year-over-year. Price per square foot ranges from $760 to over $1,120/sq ft depending on location, with Yountville commanding the highest premiums due to its walkable access to Michelin-starred dining. Nearly half of Healdsburg's luxury transactions were all-cash, signaling competitive demand for constrained inventory.

With only a handful of active listings in these town centers at any given time, seller's market dynamics persist even as other segments cool.

Why this market remains resilient: Buyers who want true walkability know exactly what they're looking for, and supply is limited. There's no substitute for town-integrated living, which means these properties aren't competing with lower-priced alternatives in other locations. The clarity of the value proposition—and the scarcity of inventory—creates sustained pricing power.

2. Connected Privacy

Kenwood, Dry Creek benchlands

This is the middle ground—land and privacy, but not isolation. You have acreage (typically 2-5 acres), views, and genuine separation from neighbors. But you're also 10-15 minutes from town, tasting rooms, and restaurants. It's Wine Country ownership that doesn't require you to choose between seclusion and accessibility.

These properties appeal to buyers who want enough space to feel like they've left the city behind, but who also don't want every meal to require a 25-minute drive. You can host a dinner party without your guests needing to Uber back to a hotel. You can take a morning walk that ends at a coffee shop if you want it to.

The trade-off: You're not in the center of things, but you're also not completely removed. It's the "Goldilocks" zone—which means it attracts a broader range of buyers and tends to hold value steadily across market cycles.

Balanced Market Dynamics

Connected Privacy properties are seeing 66-80 days on market with stable pricing in the $615-$650 per square foot range. This segment shows modest but steady appreciation and attracts both primary residence buyers and frequent-visiting second-home owners.

Why this market holds steady: This is the broadest segment—appealing to buyers who want some land and some accessibility. In a selective market, that flexibility is an advantage. Buyers can more easily envision themselves here, which maintains consistent demand across market cycles.

3. Total Privacy

Glen Ellen hillsides, Calistoga

Your guests will ask for restaurant recommendations, and you'll realize the closest option is 25 minutes away. That's not a problem—it's the point. The weekend happens entirely at home: long mornings by the pool, dinners you cook yourself, evenings where your only neighbors are oaks and vineyard rows.

These are larger parcels—often 10+ acres—for buyers who want the luxury of land and silence. This is Wine Country ownership for people who are deliberate about solitude, who want to wake up to uninterrupted views, and who don't need the town to provide entertainment. The property itself is the destination.

The trade-off is explicit: you gain space and seclusion, you give up spontaneity and walkability. Guests are captive to your hospitality. Every outing requires planning and a drive.

The Strategic Buyer Advantage

Privacy-focused estates are seeing 115+ days on market with elevated inventory levels (up 18% in pockets like Glen Ellen). This extended timeline reflects a fundamental shift: buyers in this segment are being highly selective, and sellers are adjusting expectations accordingly.

Why this market requires patience: Total Privacy properties demand a very specific buyer—someone who genuinely wants seclusion and is prepared for the operational reality of a remote estate. In a hot market, aspirational buyers stretched into this category. In a selective market, only committed buyers engage. That means longer timelines but also more motivated sellers and real negotiating leverage for the right buyer. If this is what you're looking for, 2025 created a rare opportunity window.

4. Effortless/Managed Living

Stanly Ranch, Montage Healdsburg, Four Seasons

This is Wine Country with zero mental overhead. No coordinating landscapers, no thinking about pool chemistry, no wondering if the house will be pristine when you arrive. Everything is handled. You want the Wine Country experience without the operational burden of maintaining a second home.

The amenities are resort-level: spas, fitness centers, concierge services, on-site dining. You can arrive with a suitcase and leave the same way. For time-constrained buyers—executives, frequent travelers, people juggling multiple properties—this is Wine Country ownership that doesn't compete for bandwidth.

The trade-off: significantly higher per-square-foot costs, HOA fees, and less autonomy. You're part of a managed community with rules and structures set by the developer. But for many buyers, that's exactly the value proposition.

The Turnkey Premium

Managed residences are commanding $1,200 to over $2,100 per square foot—roughly double what comparable standalone homes cost—and moving in under 45 days on average.

Why this market is accelerating: Ultra-high-net-worth buyers are increasingly treating Wine Country as an amenity, not a project. In a selective market where buyers are cautious about taking on complexity, turnkey solutions become disproportionately valuable. The "pay for convenience" premium isn't just holding—it's expanding. Buyers who want Wine Country without friction will pay decisively to get it.

The Takeaway

Wine Country's 2025 market revealed meaningful differences in how each segment performed. Town-integrated properties faced competitive demand and constrained inventory. Privacy-focused estates offered negotiating leverage for patient buyers. Turnkey communities commanded premium pricing for buyers prioritizing convenience.

For buyers entering the market in 2026, the opportunity is in understanding these distinctions before you start touring. Know whether you're competing in a 45-day market or negotiating in a 115-day market. Know whether you're paying a premium for walkability or capturing value in a privacy segment with leverage. The data gives you a roadmap to make informed decisions rather than emotional ones.